Despite the cyclical challenges of 2025, India’s structural growth story remains strong. Favourable demographics, rising urbanisation, and a policy environment focused on long-term stability continue to support the country’s economic potential. However, global headwinds cast a shadow, ensuring the path ahead remains one of cautious optimism.

India stands at a pivotal moment this year, balancing near-term headwinds with its long-term structural strengths. While global economies wrestle with the ramifications of geopolitical conflicts, trade disputes, and monetary tightening, India continues to chart its path with cautious optimism. The country’s economic story this year is one of recalibration, where policymakers focus on stabilising growth, maintaining macroeconomic stability, and preparing for sustained prosperity.

Economic Growth – ACyclical Pause in a Structural Ascent

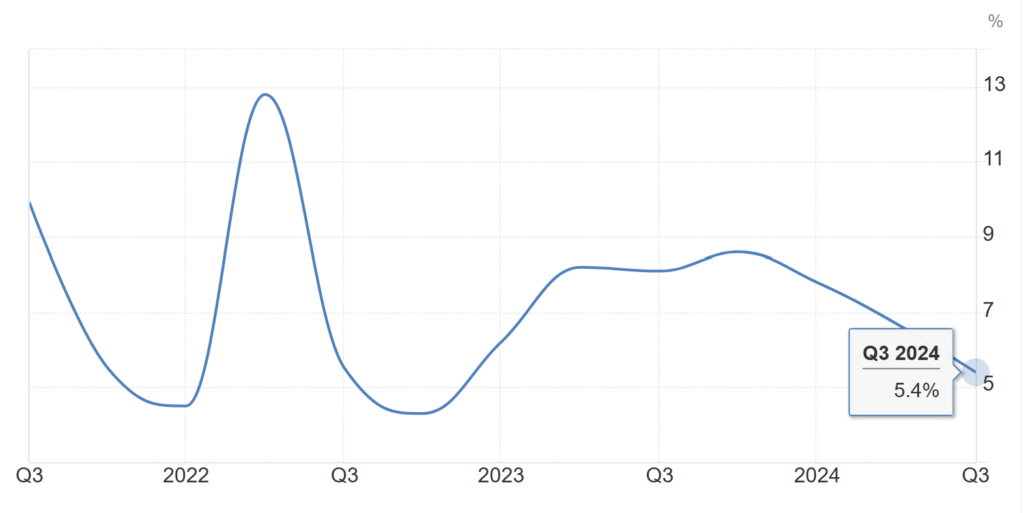

Figure 1: India quarterly GDP growth;

Source: Ministry of Statistics and Programme Implementation (MOSPI)/TradingEconomics

After the strong recovery seen in recent years, India’s economic growth is expected to moderate in 2025, reflecting the natural cyclical dynamics of a maturing post-pandemic recovery. Growth is forecast at approximately 6.3%, a slight dip from previous years but still robust in the context of global challenges. This moderation is shaped by fiscal consolidation efforts aimed at controlling deficits and tighter monetary policies designed to temper demand.

Rural consumption is finally expected to emerge as a bright spot, bolstered by favourable agricultural output and targeted government spending on rural infrastructure. However, urban consumption, which had been a driver of growth, shows signs of deceleration. The slowdown in credit growth, particularly for personal loans, reflects the lagged effects of tighter monetary policy and macro-prudential measures by the Reserve Bank of India (RBI).

Investment trends tell a mixed story. Public capital expenditure remains strong, underscoring the government’s continued focus on infrastructure. However, private investments, though gradually recovering, remain constrained by global uncertainties, including trade disputes and volatile commodity prices. Export growth, while steady in services, faces headwinds in goods trade due to weaker global demand.

At the heart of this slowdown is a broader normalisation of economic activity. The surge in growth witnessed in the immediate aftermath of the pandemic was always unsustainable in the long run. What is more likely is India settles into a steadier growth path, reflecting its underlying potential of around 6% over the medium term.

Inflation – Easing Pressures Amid Persistent Risks

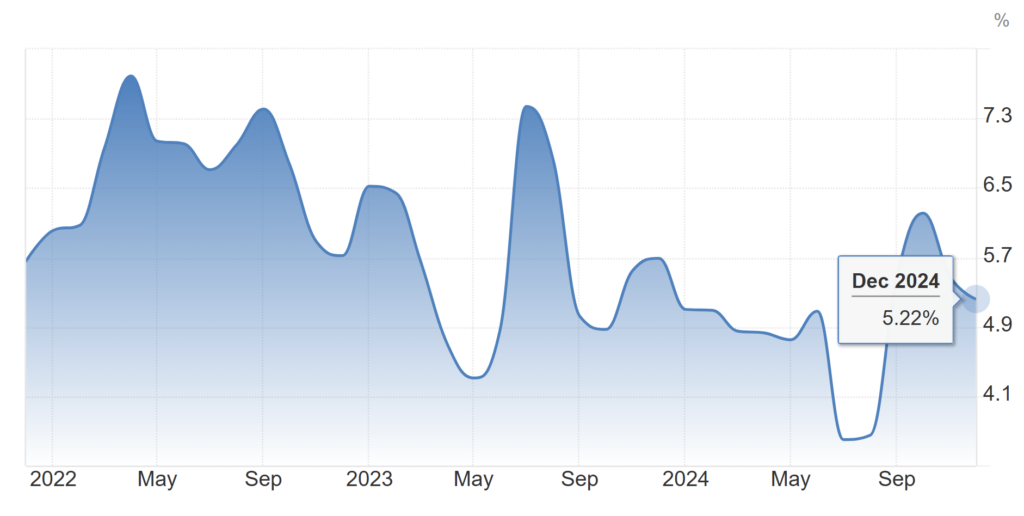

Figure 2: India annual inflation;

Source: Ministry of Statistics and Programme Implementation (MOSPI)/TradingEconomics

Inflation in India is set to ease in 2025, providing much-needed relief to households and businesses. Headline inflation is forecast to average around 4.2–4.3%, aligning with the RBI’s target range. This decline will be driven by favourable agricultural conditions, which have improved food supply, and easing global commodity prices, which have reduced cost pressures across sectors.

Food inflation, a key contributor to India’s consumer price index, is expected to moderate significantly due to a decent monsoon season and increased sowing of critical crops. Rural areas are likely to benefit disproportionately, as lower food prices enhance purchasing power. Core inflation – excluding volatile components like food and fuel – is also expected to remain stable, hovering around 4%, reflecting subdued demand pressures in other parts of the economy.

However, this optimistic inflation outlook is not without risks. Geopolitical tensions, particularly those affecting energy markets, could lead to a resurgence of oil price volatility. Additionally, global trade uncertainties and weather-related disruptions to food supply chains could still pose challenges. Policymakers will need to remain vigilant, balancing the need to support growth with the imperative of maintaining price stability.

While inflation appears to be on a favourable trajectory, the risks underscore the importance of prudent monetary policy and continued fiscal discipline. Policymakers are aware that any deviation from this path could unsettle the broader economic environment.

Monetary Policy – Prudent RBI Easing Amid Uncertainty

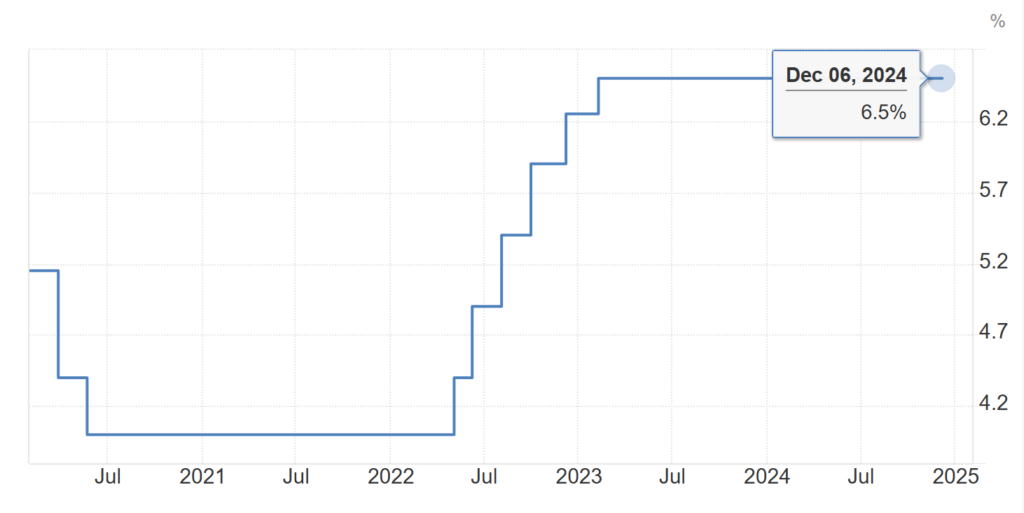

Figure 3: India Repo rate; Source: RBI/TradingEconomics

The Reserve Bank of India enters 2025 with a cautious approach to monetary easing. While growth considerations call for lowering interest rates, external vulnerabilities and persistent dollar strength require prudence. The RBI is expected to deliver modest rate cuts, with the repo rate likely to decline to 6.0% by mid-year. This reflects a measured response to the slowing economy while avoiding the risks associated with aggressive easing.

Liquidity management is expected to play a critical role in the central bank’s strategy. To mitigate the impact of foreign exchange interventions and ensure adequate credit availability, the RBI is likely to introduce measures that enhance liquidity in the banking system. This approach aims to balance the need for monetary accommodation with the imperative of maintaining financial stability.

Despite these measures, the scope for significant easing remains limited. Persistent global risks, including the possibility of higher oil prices and stronger US yields, constrain the central bank’s ability to adopt a more accommodative stance. The RBI’s challenge will be to navigate these competing pressures while anchoring inflation expectations and supporting growth.

The Rupee – Volatility without RBI Intervention

Figure 4: USD/INR as of Jan 24, 2025; Source: TradingEconomics

The Indian rupee will face challenges this year as external pressures continue to weigh on emerging market currencies. A stronger US dollar, driven by tighter monetary policies in advanced economies, has created headwinds for the rupee. Near-term depreciation appears likely, with the USD/INR exchange rate potentially touching 89 as higher oil prices and sustained portfolio outflows strain India’s Balance of Payments (BoP).

India’s trade dynamics further complicate the picture. While the narrowing trade deficit provides some relief, slowing goods exports and rising imports, particularly energy-related, remain concerns. These factors have reduced the RBI’s ability to intervene aggressively in forex markets without further depleting reserves. The sharp decline in forex reserves, which fell significantly from their 2024 peak, underscores the delicate balance the central bank must strike between supporting the rupee and maintaining external stability.

However, the medium-term outlook for the rupee offers a more optimistic view. As inflation moderates and capital flows stabilise, the rupee is expected to recover some ground. By year-end, the USD/INR rate could settle near 85-86, reflecting a balance between short-term pressures and the resilience of India’s external account.

External Balances – Strength Amid Uncertainty

India’s external account remains a cornerstone of macroeconomic stability in 2025. The current account deficit (CAD) is expected to stay manageable at around 1.3% of GDP, reflecting strong services exports and moderating oil prices. This stability is further supported by structural FDI inflows, which bolster the external account despite global uncertainties.

The Balance of Payments (BoP) surplus, however, is likely to be smaller than in previous years, reflecting sustained foreign portfolio outflows and rising import costs. The RBI’s active intervention in forex markets has also contributed to a decline in forex reserves, which now stand at around $650 billion – a robust but reduced buffer compared to their 2024 peak.

—

Looking ahead, India’s external resilience will depend on its ability to skirt global uncertainties, including trade tensions and volatile commodity markets. Policymakers will need to remain vigilant, ensuring that external shocks do not derail the broader economic narrative.

2025 presents a year of balancing opportunities and risks for India’s economy. While global challenges loom, India’s structural strengths, including favourable demographics, rising urbanisation, and a policy focus on stability, offer a solid foundation for growth. Policymakers must continue to work through these complexities, ensuring that India’s growth trajectory remains steady and resilient, positioning the country for long-term prosperity despite the headwinds of the present. The game of balance is crucial in steering India through this pivotal phase of its economic journey.