While BRICS+ remains an economic force with growing influence, particularly in EM trade, it is still

limited by the structural entrenchment of the dollar in global markets. And the next five years will likely see a gradual increase in the use of local BRICS currencies.

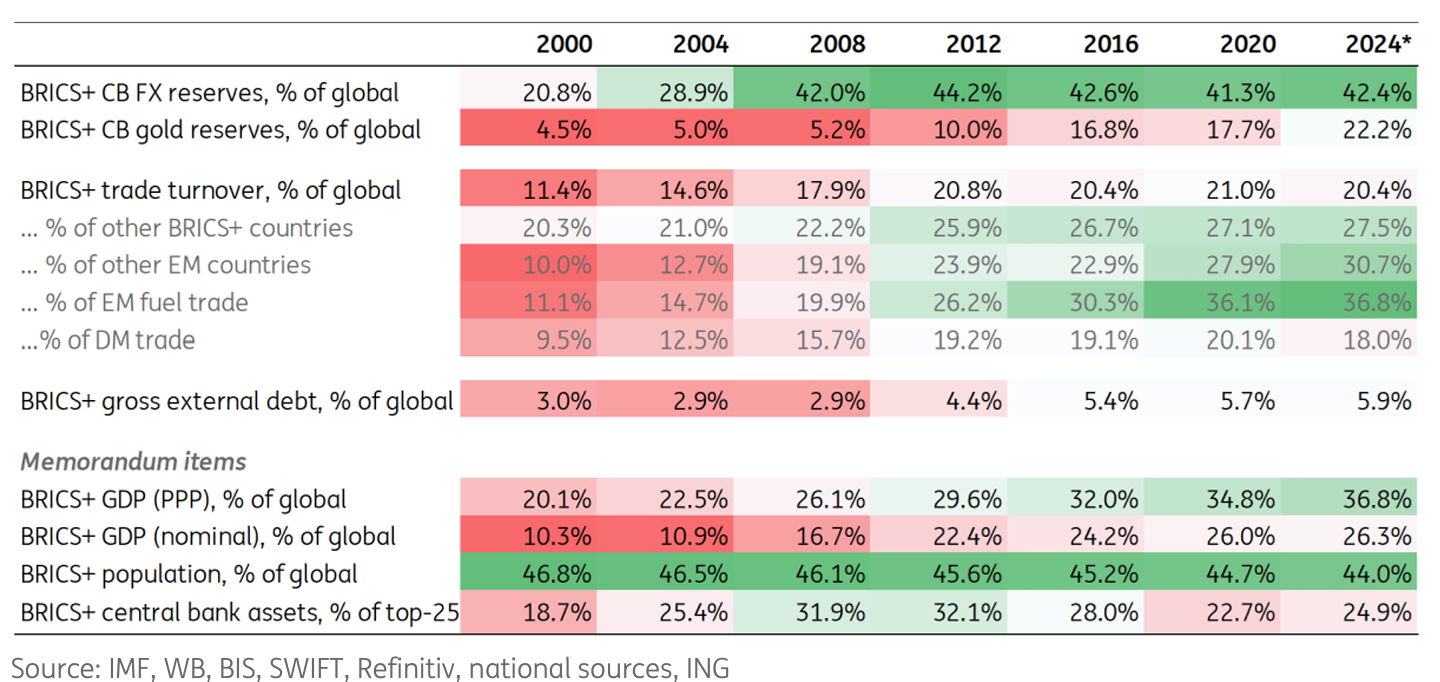

As the BRICS bloc (Brazil, Russia, India, China, South Africa) continues to grow – recently adding countries like Egypt, Ethiopia, Iran, and the UAE – their push to challenge the US dollar’s dominance has gained momentum. BRICS+ now represents about 44% of the world’s population and controls significant portions of global GDP and FX reserves. However, despite this growing influence, BRICS+ faces critical limitations in dethroning the US-led bloc, including a lack of currency stability and established financial institutions.

BRICS+ has shown commendable resilience in global trade and currency influence. The bloc controls around 42% of central bank FX reserves, with a preference for gold and non-dollar reserve diversification. However, despite concerted efforts, the dollar remains deeply entrenched globally, accounting for 59% of international reserves and dominating key markets for foreign exchange, debt securities, and global payment systems.

BRICS+ and the Western Bloc

The BRICS+ bloc’s trade strength is undeniable in certain sectors. For example, it accounts for 37% of emerging market (EM) fuel trade, and in the broader EM arena, it has steadily increased its trade share with non-Western markets. Yet, despite these gains, BRICS+ nations still only contribute to about 20% of total global trade, while developed markets (DMs) dominate with nearly 60%. In terms of oil production, the BRICS+ bloc holds a 30% share, which might reach 41% if Saudi Arabia joins. However, given the highly dollarized trade in the Americas, the impact of these shifts will likely be only incremental rather than revolutionary.

BRICS+ has placed de-dollarization high on its agenda, recognising reducing dollar reliance could strengthen the bloc’s global financial leverage. This agenda aims to curb US economic dominance by increasing the use of local currencies and digital payment platforms in cross-border transactions, which could in theory lead to a gradual diversification away from the dollar. However, current data shows that only about 6.8% of global FX derivatives are settled in BRICS currencies, with a similar percentage in SWIFT transactions.

A significant challenge to the de-dollarization push is the lack of sufficient external debt denominated in BRICS currencies, which remains modest compared to the dollar’s ubiquity. Also, the bloc’s banking sector and financial markets lack the infrastructure required for global financial operations, making BRICS currencies less attractive as stable stores of value or reliable mediums of exchange.

While BRICS+ countries are pioneering the use of CBDCs, such as through the m-Bridge project led by China, UAE, and Thailand, the initiative’s impact on global dollar use is likely to be incremental over the next five years. CBDCs could eventually streamline cross-border transactions, reducing the reliance on intermediary dollar-based transactions. However, for now, the technology, governance, and adoption hurdles prevent CBDCs from posing a formidable challenge to the dollar in the short terms.

Over the coming years, the economic clout of BRICS+ is expected to grow steadily, bolstered by internal trade, EM partnerships, and greater control over strategic resources. However, full de-dollarization remains a distant prospect, as even emerging economies often favour established DM currencies due to their stability and liquidity. Consequently, while BRICS+ will likely see gains in trade influence, the bloc’s currency-driven economic impact is expected to remain constrained by structural limitations.

Strategic Implications for Global Organisations

Given this dynamic landscape, global companies must proactively adapt their supply chains, market strategies, and financial practices to mitigate risks and leverage new opportunities.

- Supply Chains and Sourcing: Organisations should prioritise flexibility in supply chain management. With BRICS+ increasingly advocating for “friend-shoring” among member nations, Western businesses may face trade barriers or price fluctuations in key materials, especially in fuel and rare minerals. Businesses should thus consider building diversified and geographically flexible sourcing networks to safeguard against political disruptions or shifts in trade regulations.

- Market Realities and Consumer Choices: Consumer preferences within the BRICS+ bloc are evolving, influenced by nationalistic trends and a pivot towards self-reliant economies. To capitalise on these markets, Western brands may need to adapt product offerings and marketing strategies to align with local preferences. Furthermore, if trade flows between BRICS+ members and EM countries continue to grow, companies with established operations in these regions will be better positioned to capture emerging market shares.

- Financial Operations and Currency Hedging: Given the increasing unpredictability of currency values amid de-dollarization efforts, companies with exposure to BRICS+ economies should adopt robust currency hedging practices. For example, businesses with significant exposure to China or Russia may explore hedging in the renminbi or ruble. This approach mitigates risks associated with dollar fluctuations, which could become more pronounced if BRICS+ increases local currency trade. Furthermore, organisations should consider expanding their multi-currency transaction systems to handle payments in local currencies, aligning with the bloc’s de-dollarization objectives.

- Manufacturing Strategies: For companies with manufacturing interests in BRICS+ countries, aligning production with local supply chains could provide an advantage in market access and cost efficiency. For instance, local production in India, China, or Brazil could protect against potential trade imbalances and enable manufacturers to bypass import tariffs, all while tapping into the bloc’s growing consumer base.

While BRICS+ remains an economic force with growing influence, particularly in EM trade, the bloc is still limited by the structural entrenchment of the dollar in global markets. The next five years will likely see a gradual increase in the use of local BRICS currencies, particularly in intra-BRICS+ trade and emerging markets, although true de-dollarization is improbable without systemic shifts in global finance.

For global companies, the message is clear: prepare for a multipolar currency environment by diversifying currency portfolios, building flexible supply chains, and aligning products to local tastes in BRICS+ markets. By hedging risks and positioning strategically, companies can better navigate the evolving global economic order, which will continue to be shaped by the complex interplay between BRICS+ aspirations and the resilience of the rest.