Global Central Banks at the Crossroads

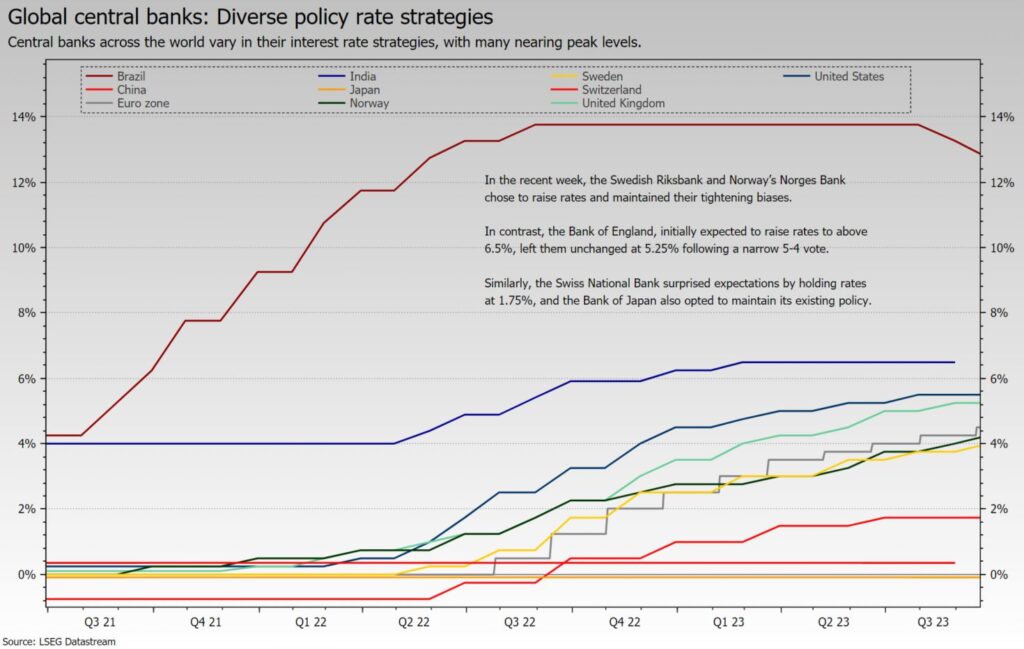

Central banks across the world vary in their interest rate strategies, with many nearing peak levels. Market sentiments favour ‘higher for longer’ rates, amid subdued inflation and decelerating growth.

A Gradual Ascent to Peak Rates

Central banks have played a pivotal role in steering their respective economies through the tumultuous waters of the post-pandemic era. In this context, it’s crucial to understand that the interest rate policies of central banks are not monolithic; they differ depending on a nation’s economic conditions, outlook, and monetary strategy. While some central banks are still in the process of raising interest rates, others have arrived at or are approaching their perceived terminal rate –i.e., their peak levels.

Image: Global policy rates; Source: LSEG

The President of the European Central Bank (ECB), Christine Lagarde, provided valuable insight during the September monetary policy presser. While she did not definitively declare that rates had reached their peak, her remarks underscored the ECB’s stance. Lagarde emphasised the importance of both the level and duration of interest rates, implying that the focus might shift more toward the latter. This nuanced communication suggests that the ECB believes its current interest rates, if sustained for a sufficient period, will significantly contribute to achieving the inflation target. In essence, the ECB is signalling that rates have likely peaked, a sentiment shared by many market analysts. The expectation is that there will be no further rate hikes in this cycle, and the possibility of a rate cut mid-2024 is on the horizon.

But why doesn’t the ECB explicitly declare that rates have peaked? The answer lies in the central bank’s commitment to being data-dependent and its reluctance to trigger market reactions prematurely. A definitive declaration of peak rates could prompt markets to price in rate cuts, thereby easing financing conditions and potentially undermining the effectiveness of the central bank’s monetary policy decisions and their long battle against inflation running in several-decade highs in most of the developed world.

The ability to maintain stable rates without raising them further hinges on preventing markets from prematurely anticipating rapid rate cuts. So far, the ECB has managed to navigate this fine line, as rate expectations initially retreated but have since risen due to the more hawkish comments from certain Governing Council members who suggested the possibility of another hike in December.

Across the Atlantic, the US Federal Reserve (the Fed) finds itself in a different economic scenario. The Fed’s recent dot plot projections (i.e., future policy rate projections of its committee members) indicate a belief that at least one more rate hike is needed, with a commitment to keeping rates elevated for an extended period. However, it’s important to note that individual forecasts within the Fed’s ranks vary significantly for the coming years.

While some argue that the Fed’s tightening bias is aimed at preventing an easing of financing conditions, many experts believe this bias is sincere, and they anticipate another rate hike in this cycle. Thus far, the Fed has been successful in conveying the message that interest rates will remain higher for a more extended period. In fact, market expectations for short-term rates at the end of the following year are currently hovering at or near cycle highs.

Interest Rate Expectations and Market Sentiment

Market sentiment plays a pivotal role in shaping interest rate dynamics. The belief that interest rates will remain elevated for an extended period has gained traction, as evidenced by market pricing. Longer-term yields have surged, with the US 10-year Treasury note yield recently reaching a 16-year high of about 4.5%. Several factors contribute to these higher yields, including the resilience of the US economy and ongoing reductions in central bank bond portfolios, i.e., increased supply.

Given the expectation of another rate hike from the Fed, which isn’t fully priced into the markets, there is potential for further upside in US yields in the short term. However, the outlook for Euro-area yields is somewhat more constrained.

Interestingly, comparing US and Euro-area yields reveals interesting trends. Market pricing currently reflects the anticipation of higher long-term interest rates in the US relative to the Euro area. Specifically, the market is pricing in a short-term rate of just under 4% in the US for the next decade, compared to slightly above 3% in the Euro area. This spread has widened over time, and there is room for it to increase further.

Future Rate Decisions and Increasing Uncertainty

In the recent week, multiple central banks made critical decisions that shed light on the evolving landscape of interest rates. The Swedish Riksbank and Norway’s Norges Bank chose to raise rates and maintained their tightening biases. In contrast, the Bank of England, initially expected to raise rates to above 6.5%, left them unchanged at 5.25% following a narrow 5-4 vote. Similarly, the Swiss National Bank surprised expectations by holding rates at 1.75%, and the Bank of Japan also opted to maintain its existing policy.

These central bank decisions illustrate the proximity to peak rates and the growing uncertainty surrounding future monetary policy actions. Some emerging market central banks, such as in Brazil and Vietnam, have already started cutting interest rates, looking to boost their economy amid inflation levels under control. Irrespective, central banks worldwide face the daunting task of balancing economic recovery, inflation management, and market expectations in an era characterised by unprecedented challenges.

As the world grapples with the complexities of post-pandemic economics, central banks continue to be at the forefront of policy decisions that influence interest rates and, by extension, the global economy. While the path forward may be marked by uncertainty, the actions and communications of central banks will remain a guiding light for investors, businesses, and individuals alike. As Christine Lagarde aptly put it, “Both the level and duration of rates matter.” The delicate balancing act between the two will shape the future of interest rates and, in turn, the economic landscapes of nations around the world.

Know more about our Top Ranked PGDM in Management, among the Best Management Diploma in Kolkata and West Bengal, with Digital-Ready PGDM with Super-specialization in Business Analytics, PGDM with Super-specialization in Banking and Finance, and PGDM with Super-specialization in Marketing.