Defying Gravity: De-Dollarization who?

The Russia-Ukraine crisis, coupled with mounting tensions between the US and other nations, has prompted discussions surrounding de-dollarization – the gradual reduction in the use of the dollar in international trade and finance. Despite challenges, recent data and analyses suggest ‘de-dollarization’ isn’t really a term to be taken seriously yet.

The US dollar, revered as the bedrock of the global financial system, has faced escalating speculation regarding its potential demise amidst geopolitical upheavals and shifting economic dynamics. In the aftermath of the Russia-Ukraine conflict and subsequent sanctions imposed by the US and European nations, economists anticipated a weakening of the dollar’s grip on the global financial system. For years, FX strategists’ consensus forecasts have consistently predicted a weaker dollar. However, during this time, the dollar’s dominance has not only persisted but, in fact, strengthened across various sectors of the global economy.

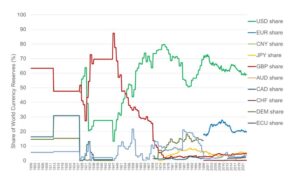

Figure 1: About 60% of the world’s currency reserves are in US dollars; Source: Gerding and Hartley, “De-Dollarization? Not So Fast” (June 13, 2023). Available here.

King Dollar

One of the pillars supporting the dollar’s hegemony is its prevalence in central bank reserves and foreign-exchange trading. Despite geopolitical tensions, the share of US dollars in central bank reserves has remained relatively stable, underscoring the enduring appeal of dollar-denominated assets. Moreover, the US dollar continues to command a significant share of foreign-exchange transactions, reinforcing its status as the preferred currency for global trade. These trends challenge the narrative of de-dollarization, highlighting the dollar’s resilience in the face of geopolitical turmoil.

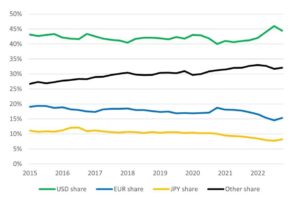

Another critical dimension of the dollar’s dominance is its role in global debt markets. Recent data reveal a significant expansion in the share of global debt denominated in dollars, indicating continued confidence in dollar-denominated assets. Despite expectations of diversification, investors and institutions continue to flock to US Treasuries – the largest market of any kind in the world – and other dollar-denominated instruments, bolstering the dollar’s position as a safe haven and store of value. This expansion in global debt markets further solidifies the dollar’s status as the world’s primary reserve currency.

Figure 2: Nearly half of all global debt denominated in dollars; Source: Gerding and Hartley, “De-Dollarization? Not So Fast” (June 13, 2023). Available here.

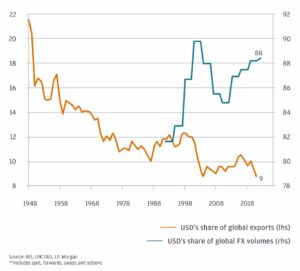

In addition to its role in central bank reserves and debt markets, the dollar maintains a steady presence in trade invoicing and performance metrics. Data collected by economists indicate that the dollar’s share of trade invoicing remains robust, with a significant portion of global imports and exports invoiced in dollars. Furthermore, recent advancements in the dollar’s performance, including its accelerated strengthening in the aftermath of the Ukraine crisis, underscore investors’ continued confidence in the greenback.

Assessing ‘De-Dollarization’ Talks

While the dollar’s resilience is evident, discussions surrounding de-dollarization persist, driven by geopolitical shifts and evolving economic dynamics. De-dollarization entails significant implications for global markets and trade, potentially reshaping economic and financial landscapes. However, the path to de-dollarization is fraught with challenges, and the likelihood of a swift transition away from the dollar remains unlikely.

- Global Markets and Trade: Fundamentally, de-dollarization could shift the balance of power among nations, leading to a reconfiguration of global markets and trade. While marginal de-dollarization may occur, rapid de-dollarization appears unlikely in the near term. The considerable advantages associated with the dollar, coupled with the enduring global network of alliances and partnerships established by the US, mitigate the prospects of a swift transition away from the dollar. Instead, partial de-dollarization, particularly in regions where alternative currencies gain traction, may gradually reshape economic and financial spheres of influence.

Image: The dollar has retained its transactional dominance, but its share of global exports has decreased; Source: J.P. Morgan research.

- Alternative Currencies: In the pursuit of de-dollarization, alternative currencies have emerged as potential contenders to challenge the dollar’s dominance. Notably, China’s renminbi has garnered attention as a prospective reserve currency, with efforts underway to internationalize its usage. However, the renminbi’s global footprint remains limited, and the transition to a multi-currency system is expected to unfold gradually over time. While the renminbi may assume a greater role in the global economy, the dollar’s supremacy is likely to persist in the foreseeable future.

- The Role of Oil Markets: Signs of de-dollarization are also evident in oil markets, where the US dollar’s influence is waning. Traditionally, the dollar’s strength has been a key determinant of global oil prices. However, recent developments, including the acceptance of alternative currencies for oil transactions, signal a shift away from dollar-denominated pricing. While the dollar’s importance in oil markets may diminish over time, its impact on global oil prices remains a subject of debate.

The US dollar’s resilience amidst discussions of de-dollarization underscores its enduring dominance in the global financial system. Despite geopolitical turmoil and shifting economic dynamics, the dollar continues to serve as the preferred currency for central banks, investors, and traders worldwide. While the path to de-dollarization remains uncertain, the dollar’s supremacy is likely to persist in the foreseeable future, shaping global markets and trade in profound ways. As the world navigates the complexities of a multi-currency system, the US dollar remains a pillar of stability in an ever-changing economic landscape.

As of right now, ‘de-dollarization’ isn’t really a term to be taken seriously.

Read ‘De-Dollarization? Not So Fast’ here.

[Concluded]